The expanding adoption of electronic innovations in the economical procedure is pushing the tutorial dialogue about its probable gains or negatives to glance for a stable foundation of empirical evidence. Although prior scientific tests have investigated the results of information and facts technologies (IT) adoption on distinct banking results (e.g. Beccalli 2007, Koetter and Noth 2013), results so much have been inconclusive and, aside from a several exceptions (Pierri and Timmer 2020, Kwan et al. 2021), have not still been examined through periods of disaster.

In our new paper (Branzoli et al. 2021), we exploit the Covid-19 pandemic – an unpredictable party that is probably to have increased the worth of digital prowess as a resource of aggressive advantage – to analyse versions in credit across Italian banking companies affiliated with distinctive ex-ante degrees of IT adoption. We find that IT-intense banking companies greater their lending to non-economic businesses (NFCs) much more than some others in the months subsequent the outbreak of the pandemic the increase was economically sizable even when nationwide mobility restrictions were lifted and community health and fitness problems improved.

Measuring banks’ IT adoption

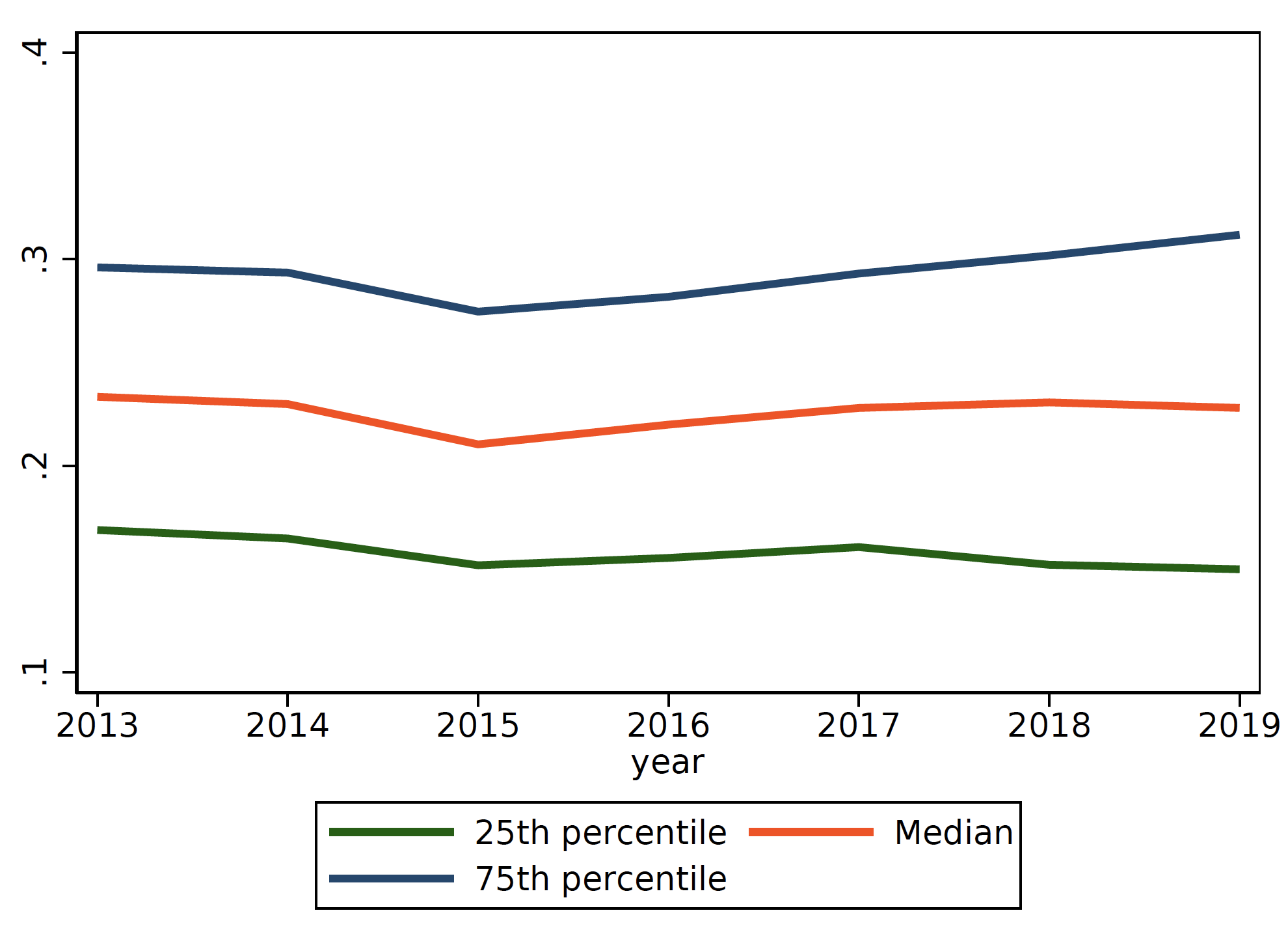

We measure banks’ level of IT adoption using exclusive facts on IT-linked expenses documented in the income statement and survey information and facts on the use of digital systems at the bank amount. These are costs incurred for the order of hardware (e.g. particular computers, servers, mainframes) or software package, the payment of IT professionals (e.g. computer support engineers) and the outsourcing of IT companies to exterior suppliers. IT expenditures are normalised by the total operating expenses of the lender. Figure 1, Panel A, shows the evolution of the IT-to-complete fees ratio around time and across percentiles.

To assess regardless of whether a better share of IT fees is similar to a bigger diploma of IT adoption, we examine the marriage involving banks’ IT expenditures and the use of electronic technologies. We merge info on IT costs with lender-stage study information and facts on the standing of electronic transformation of the Italian banking sector.1 More exclusively, we question banking institutions to reveal which economic companies they offer on the net (e.g. loans, payments, asset administration), if any. Respondents are also asked no matter whether they have progressive initiatives under way, which know-how underlines them (e.g. big information, biometrics, artificial intelligence) and for what reason (for occasion, increasing shopper profiling or credit score possibility analysis). Controlling for a abundant set of lender features (together with dimensions, funding composition, and profitability), we locate that our measure of IT adoption is really related to banks’ diploma of digitalisation and propensity to innovate: the bigger the IT expenditures, the increased the likelihood of providing electronic solutions and participating in progressive processes.

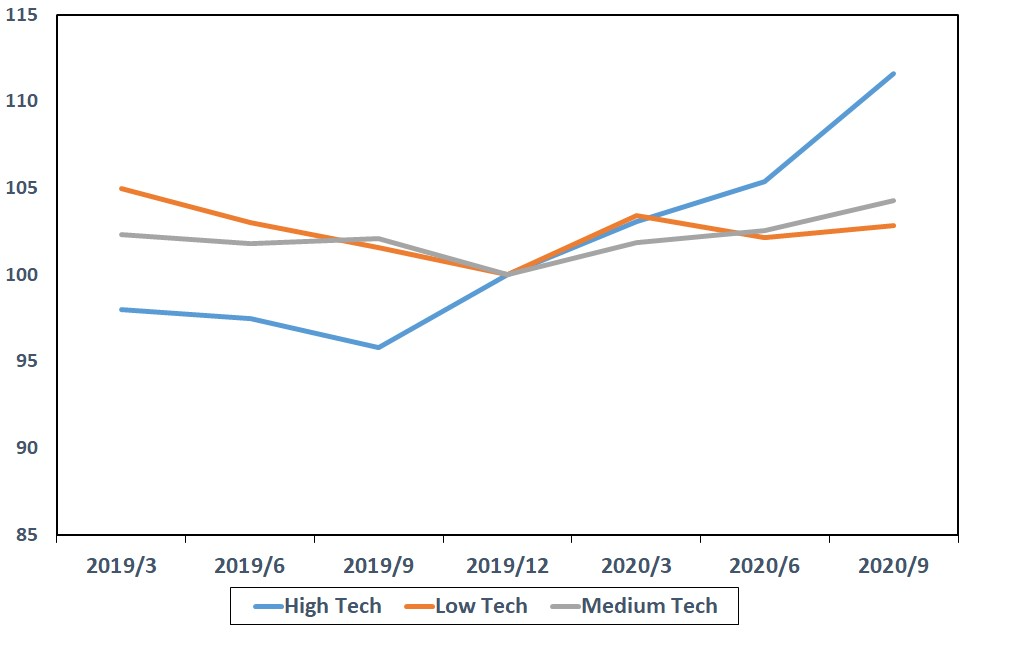

Panel B of Determine 1 displays credit score dynamics in Italy right before and just after the pandemic outbreak, based on banks’ degree of digitalisation: since the commencing of 2020 credit drawn by higher tech banking institutions (i.e. all those in the major quartile of the distribution of the IT-to-full charges ratio) improved by 11%, twice the charge recorded by other loan providers.

Determine 1 IT expenses distribution (Panel A) and credit rating dynamics throughout banks’ tech levels (Panel B)

Panel A

Panel B

Notes: The top graph displays the evolution of the 25th percentile, the median, and the 75th percentile of the distribution of the IT-to-complete expenditures ratio in every single calendar year. The bottom graph displays lending designs throughout banking institutions with various levels of IT adoption. All banking companies in our sample are break up into a few teams according to their IT-to-whole charges ratio: very low tech if they fall in the base quartile, medium tech if they stand between the next and third quartile and, significant tech if they are in the top rated quartile. The overall quantity of credit rating for each each financial institution is normalised to 100 based on the quantity of superb credit score in December 2019.

Credit rating allocation

We also examine the dynamics of credit history and its allocation across NFCs. Utilizing a variance-in-distinctions identification strategy, we find that the result of IT on credit growth was greater for borrowers hardest hit by the pandemic. NFCs located in the places of the country most impacted by the pandemic2 experienced a greater maximize in lending from higher-tech creditors. We discover positive variation in credit history for businesses running in sectors considered non-vital in the course of the lockdown and for that reason compelled to close their actual physical spots. Compact and medium-sized enterprises (SMEs) – additional uncovered than larger companies to liquidity shortfalls – have benefited the most from the advancement in loans fuelled by technologically state-of-the-art banking companies.

Digital compared to bodily channels

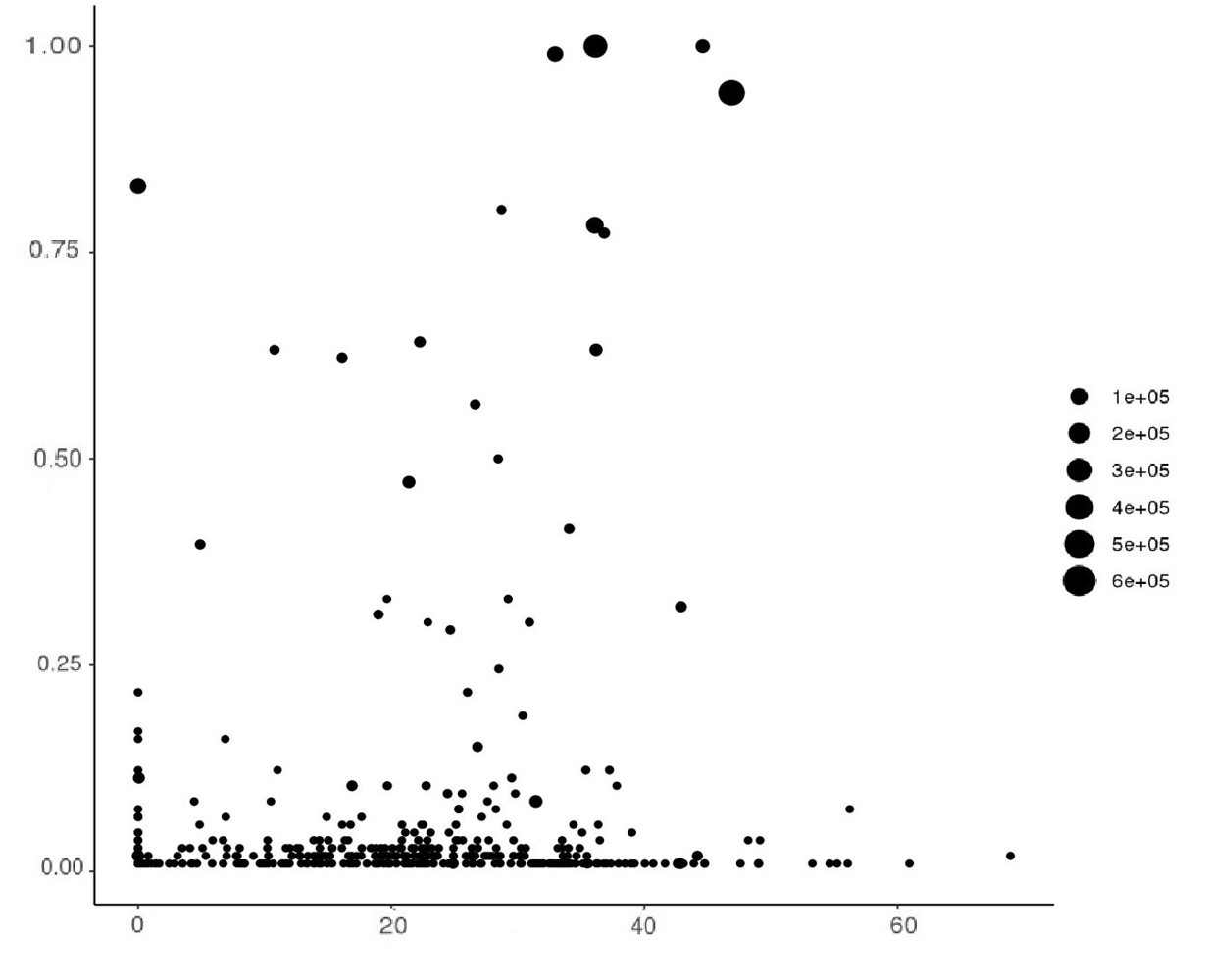

No matter whether engineering is lessening the impact of length on lending selections is below debate (Petersen and Rajan 2002, Basten and Ongena 2020, Keil and Ongena 2020). In our examination, we review the function of geographic proximity (in between loan companies and debtors) in influencing the result of technological know-how adoption on credit score for the duration of the pandemic. Figure 2 plots the bodily and electronic achieve of Italian banking institutions at the eve of the pandemic: at comparable technological ranges, the dispersion of branch diffusion demonstrates a substantial heterogeneity in banks’ business enterprise types. In exploring the relative worth of these two dimensions, we find that banks ready to provide their buyers as a result of the two conventional and electronic channels showed the best credit rating expansion from March 2020 onwards in other phrases, we provide evidence that brick-and-mortar areas continue to make a difference, when combined with a solid electronic presence of the lender.

Determine 2 Distribution of physical as opposed to electronic channels

Notes: The horizontal axis reveals the IT costs ratio. The vertical axis offers the percentage of provinces in which the bank has a department. Dimension of dots correspond to overall property in thousands and thousands of euro. All computed in 2020.

Conclusion

We lose light-weight on the effect of technologies adoption in lending during the Covid-19 pandemic. Our success propose that banking companies with a bigger diploma of pre-pandemic IT adoption have granted more credit rating to NFCs as the crisis started off to unfold. Greater electronic capabilities could possibly have served banks manage a larger sized-than-standard amount of bank loan programs, boost workflow by means of automation, and streamline approval processes. We also exhibit that, even less than severe physical limitations, customers still valued the risk of owning face-to-facial area interactions with their lender. Our examination paves the way for upcoming investigate on the lengthy-phrase effects of digitalisation in banking. As the pattern towards digital uptake is listed here to stay, banking companies require to adapt to shifting consumer choices and foresee shifts in opposition. Implications for small business product innovation will definitely lie in advance.

Authors’ notice: The sights expressed here are those of the authors and do not automatically reflect all those of the Lender of Italy.

References

Basten, C and S Ongena (2020), “Online property finance loan platforms can allow for modest banking institutions to strengthen their inter-regional diversification”, VoxEU.org, 15 August.

Beccalli, E (2007), “Does IT investment decision make improvements to bank general performance? Evidence from Europe”, Journal of Banking & Finance 31(7): 2205-2230.

Branzoli, N, E Rainone and I Supino (2021), “The function of banks’ know-how adoption in credit marketplaces during the pandemic”, Performing Paper.

Keil, J and S Ongena (2020), “It’s the conclusion of financial institution branching as we know it (and we feel fantastic)”, Doing work Paper.

Koetter, M and F Noth (2013), “IT use, efficiency, and market power in banking”, Journal of Financial Security 9(4): 695-704.

Kwan, A, C Lin, V Pursianen and M Tai (2021), “Stress screening banks’ digital capabilities: Proof from the covid-19 pandemic”, Doing work Paper.

Petersen, M and R Rajan (2002), “Does length nevertheless make any difference? The information and facts revolution in small business lending”, Journal of Finance 57(6): 2533-2570.

Pierri, N and Y Timmer (2020), “Tech in Fin right before FinTech: The value of know-how in banking through a crisis”, VoxEU.org, 9 August.

Endnotes

1 The Regional Lender Lending Study (RBLS), carried out by the Bank of Italy on a annually foundation, consists of a substantial sample of Italian financial institutions representing 90% of the deposits of the total banking technique.

2 The severity of the pandemic is tracked making use of knowledge on hospitalisations, fatalities, and alterations in household mobility at the province amount.

More Stories

Top 5 Innovative IT Insurance Services

First Steps in Designing a Pantry

Fun Facts About Radio