[ad_1]

This write-up originally appeared on Simply Wall St News.

Past 7 days Micron Technological know-how ( NASDAQ:MU ) released second quarter success. The success were easily in advance of forecasts, and direction for the 3rd quarter was raised. Just after at first getting 4.7%, the share rate tracked the sector lessen.

Micron has incredibly small anticipations priced into its current valuation. At the exact time, details heart desire seems to be much better than anticipated , and if that proceeds anticipations could make improvements to meaningfully.

Second quarter success at a look:

-

EPS: $2.14, up 118% yr on yr and 16 cents ahead of consensus estimates.

-

GAAP EPS: $2.00, up 277% year on 12 months and 16 cents ahead of consensus estimates.

-

Revenue: $7.78 bln, up 24.8% year on 12 months and $244 mln much better than anticipated.

-

Demand and charges for NAND and DRAM memory chips carry on to rise.

-

Information centre demand from customers for memory and storage is predicted to outpace broader marketplaces above up coming ten years.

-

Third quarter direction: Profits estimate elevated from $8.1 bln to ~$8.7 bln and EPS from $2.21 to ~$2.33.

Micron’s near-expression outlook has improved, while it is not likely to match the last quarter’s earnings advancement. But what genuinely matters for investors is the expectations that are at the moment priced into the inventory and how they may transform about time.

How does Micron Measure up in opposition to the Tech Sector and Semiconductor Sector?

If you appear at the Just Wall St Marketplaces site , you can watch the value-to-earnings ratio and forecast earnings development premiums for each sector, and for just about every sector in every sector.

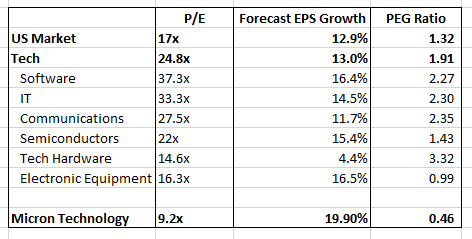

We can see that the typical P/E ratio for semiconductor stocks is 22x, which is the third least expensive among the six industries, and noticeably lower than the software package marketplace which is at 37.3x.

When we glimpse at forecast growth fees, the semiconductor marketplace is anticipated to expand at 15.4%, which is only marginally lower than the program and electronic equipment industries.

We can also combine the P/E ratio and expansion forecast by calculating a ‘PEG’ (P/E to Progress) ratio. By dividing the P/E ratio by the predicted development price we get there at values that are easier to examine . We can add Micron to the checklist two to see how it compares to the industry, the tech sector, and the semiconductor industry.

The existing PEG ratios suggest that the semiconductor industry is additional favorably valued relative to expansion anticipations than all the tech industries apart from electronic devices. This does not imply semiconductor stocks will accomplish better, but that expectations relative to forecasts are at the moment reduce.

Micron Technology’s P/E and PEG advise anticipations are even lower. The current forecast EPS expansion level for the upcoming few several years is 19.9%. Even though EPS enhanced by 182% about the last 12 months, analysts are expecting a sharp slowdown in the subsequent couple years.

Demand from customers and prices for memory and storage chips is cyclical, so revenues are normally lumpy. In reality it is tricky to forecast demand much more than a calendar year or two in advance, so analyst estimates are understandably conservative – and their forecasts are probable to alter. The very good news for buyers is that these forecasts are small, and the current P/E is minimal relative to those forecasts.

What does this signify for buyers?

The base line right here is that Micron is at present observing potent desire for its goods, although the market’s anticipations for the potential are minimal. This contrasts with a ton of other technology stocks that have optimistic forecasts and even additional optimistic valuations. This suggests downside for Micron could be restricted, when there is opportunity for substantial upside if the lengthier-expression outlook improves.

To understand additional about the organization, have a seem at our newest assessment for Micron Engineering . You can use the Simply just Wall St Screener to find other semiconductor shares with solid fundamentals.

Have suggestions on this posting? Anxious about the information? Get in touch with us instantly. Alternatively, electronic mail [email protected]

Just Wall St analyst Richard Bowman and Simply just Wall St have no situation in any of the organizations stated. This report is common in nature. We offer commentary primarily based on historical details and analyst forecasts only employing an impartial methodology and our content are not meant to be fiscal information. It does not constitute a advice to acquire or market any stock and does not choose account of your targets, or your economical predicament. We intention to convey you long-phrase targeted investigation driven by fundamental knowledge. Take note that our examination may perhaps not component in the hottest selling price-sensitive firm bulletins or qualitative materials.

[ad_2]

Supply link

More Stories

AI vs Human Jobs: Who Wins in Silicon Valley’s Future?

How AI Job Replacement is Changing Silicon Valley’s Workforce

Breakthrough AI Technology Advancements Changing Our Future