[ad_1]

Luis Alvarez/DigitalVision through Getty Photographs

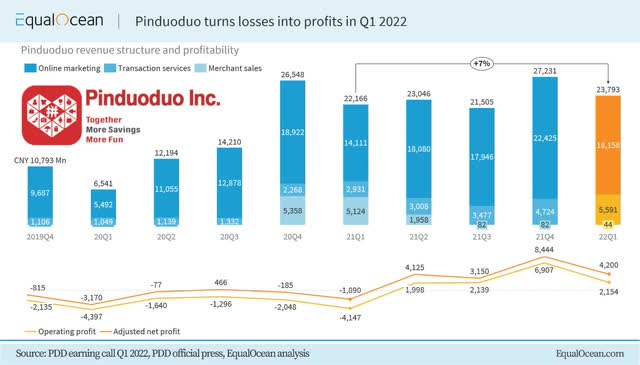

On May 27, 2022, Pinduoduo (PDD: NASDAQ) held its Q1 2022 earnings call, displaying spectacular monetary success and climbing far more than 15% during the trading working day. It’s been the fourth quarter that PDD retains building earnings given that it turned losses into gains in Q2 2021. This short article will present vital factors of the leading Chinese E-commerce agency and could restore community assurance in Chinese Concept stocks.

Constant earnings stage is coming

EqualOcean

In this quarter, PDD’s revenue achieved CNY 23.8 billion, up 7% from the prior year, pushed by an boost in revenues from on the web promoting services and profits from transaction companies, offset by the reduce in revenue from 1P trials. Revenues from on line marketing and advertising expert services reached CNY 18.2 billion, up 29% calendar year about calendar year, although transaction solutions revenue this quarter was CNY 5.6 billion, surging 91% from the identical period of 2021, which is dazzling. In conditions of price, its cost of income lessened to CNY 7.2 billion this quarter, down 16% compared to the similar quarter of 2021. Owing to this, its non-GAAP working revenue reached CNY 3.7 billion compared to the running decline of CNY 3.2 billion in the exact quarter of 2021. We consider, thinking about the latest marketplace capitalization of PDD, it is inevitable to see slower progress. Nonetheless it may perhaps not be a lousy detail as more sustainable task shelling out and extra agriculture initiatives are the major good reasons driving the approach in the earlier a few quarters.

A person noteworthy issue is that in Q1 PDD’s advertising fees had been CNY 11.2 billion, additional cutting down its proportion of the total profits to 47% (from 54% very last yr, a lot reduce than 112% at the peak). PDD, although cutting down its marketing expenditure, significantly increased its R&D bills and attained a historical substantial, up 20% from the former calendar year to CNY 2.7 billion, as it recruited far more expert talents. We consider this is a excellent sign that PDD is reshaping its irritating internet marketing technique due to the fact its establishment and spending far more consideration to building earnings by way of technological innovation.

Why change to agriculture?

As we described in our former content, because CEO Chen Lei has been the most important choice-maker of PDD, it would seem that the technique of this e-commerce corporation has changed tremendously, from focusing on advertising to concentrating on agricultural science and technologies investments. In fact, soon after one particular 12 months that he has been in the function, the strategic transformation has accomplished initial final results. Since the first income in Q2 last year, PDD has accomplished revenue for four consecutive quarters and entered a stable gain phase. This, we imagine, is owing to PDD’s extensive-time period organization investment decision in agriculture, which believes that technological know-how and abilities are the keys to marketing agricultural and rural modernization. The rising profit is a reward for seizing agriculture-related options in small-city and rural marketplaces.

Given that 2020, owing to the constant affect of the epidemic and the uncertainty introduced about by geopolitics, Chinese e-commerce businesses have all turned to fierce differentiated competitiveness. The tactic of PDD is seriously weighted toward agriculture know-how. On the a single hand, the concentration of China’s agriculture, rural areas, and farmers’ guidelines is shifting from poverty alleviation (which is realized in 2021) to rural revitalization. On the other hand, the focuses of e-commerce giants have been going from the incremental model to an present design, which usually means that re-acquire capability will grow to be 1 of the key drivers in upcoming functions. Agricultural products, as a variety of significant-frequency usage, add a significant number of profits to PDD. However, agricultural scientific exploration is a long approach of expense, and it may perhaps just take 10 several years or additional to make breakthroughs and change into mass generation. Investing in agricultural science and know-how is basically sacrificing brief-time period income and pursuing lengthy-time period sustainable growth.

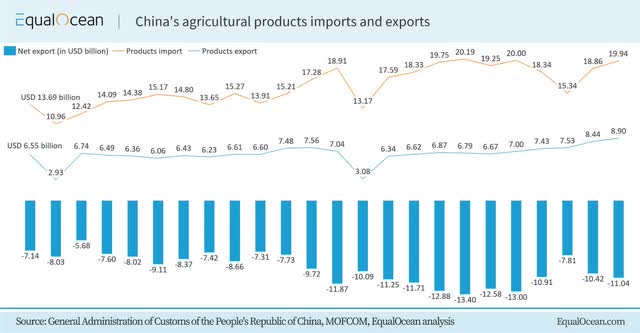

EqualOcean

Nevertheless, we believe that that this market place, nevertheless extremely challenging, has terrific likely. At the moment, at the global trade stage, China’s large value-added agricultural products and solutions nonetheless count on imports. According to the data from the Ministry of agriculture, China’s agricultural imports are generally twice the exports. This trade deficit is not mainly because China’s agriculture can’t be self-ample, but due to the fact the lack of large price-additional agricultural items. For illustration, higher value-extra agricultural products these as edible oilseeds, cereals, wheat, corn and soybeans are the types with a massive import equilibrium. At the plan stage, the nationwide agricultural and rural informatization growth plan for the ‘14th Five-Calendar year Plan’ demands that the national on the net retail revenue of agricultural merchandise should attain CNY 800 billion by 2025, which is highly in line with PDD’s approaches structure. As considerably as we are all mindful, plan developments are a essential consideration when investing in rising markets with special political environments. Primarily for World wide web corporations considering that the 20th century, Ant Group’s tentative IPO is a destructive illustration. A extremely essential truth is that because of to the political particularity, the little-town and rural market place is just one of the marketplaces that China pays near notice to. A piece of excellent proof is that, previously in 2021, Pinduoduo was between 3 technological innovation organizations counseled for their contributions to China’s poverty alleviation initiatives.

Uncovered potentials and attempts driving the profit

Given that Q1 very last yr, PDD has stopped disclosing one quarter GMV, and the progress rate of yearly energetic purchasers and normal month-to-month exercise has progressively dropped back to solitary digits. We imagine it is a fantastic system as, with the growing scale of the platform and the disappearance of the demographic dividend of the World-wide-web, it is complicated for PDD to continue on to preserve high-velocity GMV progress. In other words, the valuation quality introduced by speedy advancement is unsustainable. PDD modified its tactic at an proper time and accomplished preliminary good results.

As outlined before, PDD Fee profits in Q1 practically doubled, which we found is generally driven by the fee revenue from much more solution sales. At current, it is simple that the logistics procedures of agricultural merchandise nevertheless will need to be improved, and the distribution of assets is however incredibly uneven throughout locations. This is where by PDD saw the opportunity, by bettering this issue and benefitting from it. At the very same time, in phrases of agricultural infrastructure, PDD adopts route preparing technological know-how and community remedies. The business has in the beginning created an economical agricultural products logistics system, specifically connecting more than 1,000 agricultural output locations, and encouraging much more than 16 million farmers to participate in the electronic financial system.

Furthermore, PDD released a CNY 10 billion agricultural initiative in August 2021 to assist agricultural modernization and rural vitalization. As of March 31, 2022, nearly 40,000 higher-excellent agricultural items have been introduced on this channel. In addition, PDD launched or assisted various influential gatherings together with the intercontinental sensible agriculture competitors 2020, the World Agriinno Challenge 2021, and the to start with China Agricultural Robot innovation opposition, striving to break the regular restrictions and market the enhancement of smart agriculture. In addition, PDD has also even further amplified its financial investment in infrastructure these types of as agricultural product transportation, logistics and warehousing in the past couple quarters. All we imagine are things that endorse PDD to achieve significant advancement of this phase in new quarters.

Extensive expression bullish, challenges attract notice

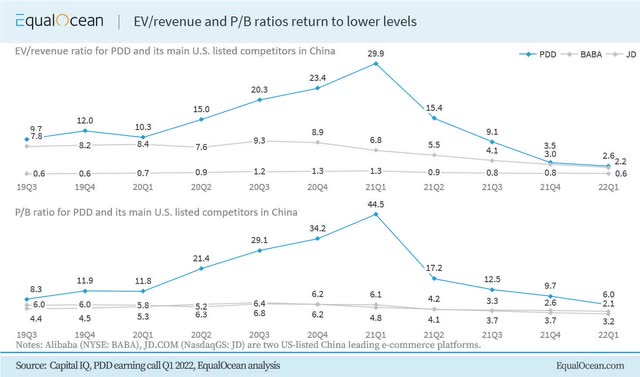

Although struggling from regulation constraints, a downturn market place and tightening Sino-U.S. relations, it is nevertheless really worth providing a guideline for PDD, as many traders are restoring their confidence of Chinese Ideas Shares. We applied EV/revenue and P/B ratio to benefit the enterprise. Contemplating that the corporation has been equipped to convert losses into earnings and its competition have substantially reduced ratios, we made the decision to use the modified historical common process. From the chart, it is obvious that the ratio is at a small degree, which we feel is mostly brought on by the regulation improvements in China recently. Based mostly on its present fiscal overall performance and its recent trading natural environment, momentum and aggressive landscape, we calculated that 7.5x EV/profits and 8.7x P/BV is an appropriate valuation for PDD in 12 months, which corresponds to a concentrate on rate of USD $91.48.

EqualOcean

We are still firmly bullish on PDD, at minimum from the standpoint of it as a worth investment. 1 working day in the foreseeable future, we could eventually discover the options and values and variations to China’s agricultural business benefiting the total Chinese society, brought by PDD’s agricultural digitalization strategy. On the other hand, under such a method, as it is tough to deliver sustained significant advancement and higher preliminary financial commitment, PDD will be more vulnerable to market fluctuations and international trade frictions in the shorter phrase, and the price tag may possibly not be satisfactory. Medium and quick-term buyers need to have to pay out a lot more focus to this. In addition, investors must also hold an eye on the SEC regulation changes of the corporation, which we consider could be the biggest menace to this financial investment.

[ad_2]

Resource backlink

More Stories

Common Mistakes To Avoid While Choosing Bolt Manufacturers

Computer and Technology Today

The Reasons Agriculture is Important