[ad_1]

This write-up is prepared by CMC APAC market analysts Kelvin Wong, Tina Teng and Leon Li

Sectors watch on the US equities

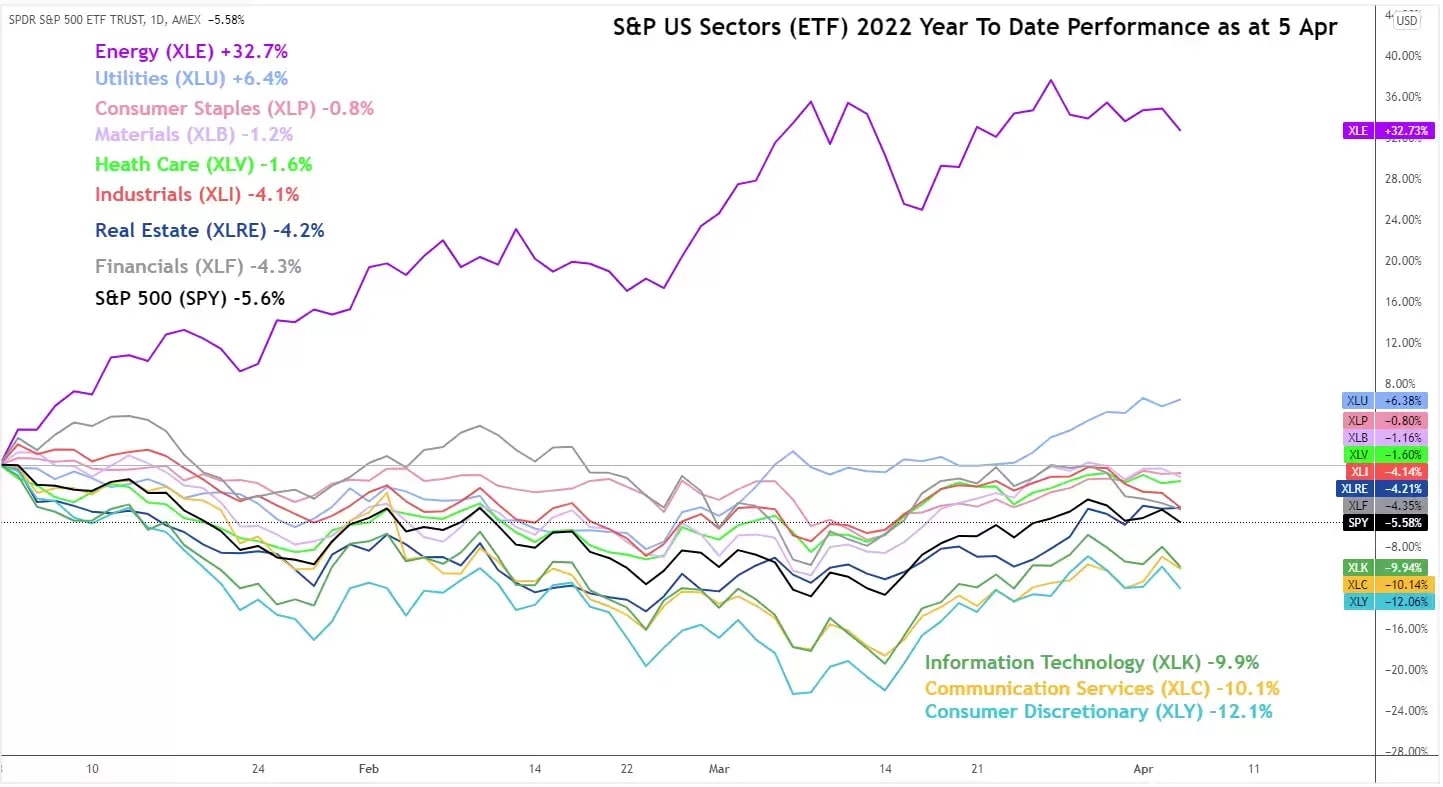

As for every above narratives, the central banks’ policies tend to be additional on pinning down the spiking shopper selling price, somewhat than stimulating expansion, in flip shifting the US economic climate into a “stagflation” period, which may possibly continue on to direct the financial commitment resources to withdraw from progress shares and rotate to the defensive sectors, this sort of as utilities, healthcare, and buyer stables. Also, we hope the strength sector will continue on to direct the way in the Q2 efficiency simply because of war-intensified offer shortage and spiking inflation.

The growth stocks, ordinarily in customer discretionary, communication companies, and technological know-how, are anticipated to underperform the S&P 500, amid slowdown in development and valuation downgrades, in which we may well see variables from unique stock’s performance dependent on the cashflow situations and the sentiment dynamics.

In addition, the financial institution stocks might undergo from a likely credit score crunch due to growing borrowing value, together with the extending sanctions on Russia.

S&P 500 Sectors Functionality

Pattern of China’s yuan from 2020 – 2022

Reviewing the craze of yuan in the previous two a long time, the USD/CNH has entered a development of considerable depreciation due to the fact May 2020.

The 2-12 months outperformance of the yuan against the US greenback is also apparent across the board as perfectly. The CFETS RMB index that steps the worth of the yuan against a basket of 24 important currencies has surged by much more than 16% due to the fact June 2020 compared to a 12% achieve observed only against the US dollar.

Source: CFETS (simply click here to enlarge chart)

Considering the fact that November past calendar year, the US Federal Reserve has started out to embark on a tightening cycle of debt reduction, interest rate hike and stability sheet reduction. In distinction, China’s monetary policy has flipped to a qualified expansionary mode where by China central financial institution, PBOC cut the reserve necessity ratio of industrial banking institutions and benchmark lending premiums. Even so, despite a more hawkish financial coverage advice engineered by the Fed versus a dovish PBOC’s mandate has unsuccessful to quit the appreciation of the yuan towards the US dollar.

The logic guiding yuan energy: PBOC tightened its financial policy regime after Could 2020 while the Fed preserved its quantitative easing programme. The lengthy-time period toughness of a currency depends on the fundamentals of a nation. China is the first region to recover from the COVID-19 pandemic crisis and its 2021 GDP development price surpassed the relaxation of the environment in typical which in turn attracted a huge volume of intercontinental funds inflows that led to a persistent pattern appreciation of the yuan.

Nevertheless, the present-day yuan’s toughness is possible to be restrained in Q2 2022, mainly due to the fact the Fed will employ a a lot more rapid interest fee hike cycle and a better quantum of quantitative tightening regime to reduce its $9 trillion well worth of bonds on its stability sheet. In addition, China’s producing sector has experienced a intense contraction in March, for this reason such weak financial information may well prompt PBOC to convey ahead and fasten its speed of financial plan easing.

In the context of China’s economic downturn, the conclusion of the Q4 2021 PBOC assembly said that the very first purpose of its financial coverage was to keep economic steadiness. Judging from this statement, the key goal of subsequent monetary plan choices will change in the direction of accomplishing steady development and hence likely forward, the monetary policy atmosphere may perhaps turn out to be far more accommodative which will probably trigger some downward stress on the yuan.

China coverage makers have always been employing a balanced control on the yuan. Precisely, they do not want it to increase or tumble drastically and China’s production sector has expert a significant slowdown in growth owing to sharp appreciation of the yuan, the modern outbreak of the Covid-19 bacterial infections in important commerce hubs such as Shenzhen and the rise of uncooked elements expenses. So, it is vital for China to obtain a secure trade level since the production sector has a significant contribution to its general financial advancement.

Does that signify a big down shift is on the cards to reverse the modern yuan’s toughness? Since the final worldwide liquidity easing cycle in 2020, a potent yuan has become a favorite for overseas capital and following the Fed has kick started out its latest desire fee hike cycle, there may possibly be an increase pressure for abroad cash to change their yuan-based economical assets holdings into US pounds. In conjunction, if PBOC lets the yuan to depreciate sharply, it could inspire foreign cash to scoop up China’s core belongings that might be detrimental from a countrywide safety standpoint. As a result, China will not enable its forex to depreciate substantially as it aims to attain a steady GDP progress of 5.5% in 2022, so the downside is predicted to be constrained.

How will the genuine estate industry be influenced?

Given that final year, China has started to employ policies to deleverage the actual estate sector by introducing the strategy of “housing is applied for dwelling and not speculation” which in switch induced a considerable credit history crunch for many assets developers that increases the danger of bankruptcies and default on their debt obligations. To ease the credit score crunch problem, PBOC has begun to relieve its financial policy considering that late past yr and inject liquidity into the home sector.

Source: Tradingview (click on to enlarge chart)

Considering that mid-March 2022, China’s actual estate sector has witnessed a sharp upward rebound, predominantly thanks to fewer stringent deleveraging procedures. Plan makers have enacted a collection of supportive measures for the authentic estate sector this kind of as mergers and acquisitions, credit score easing, assistance schemes for reasonable financing demand to enhance market self esteem.

More than 60 towns have eased constraints on household buys, reduced down-payment ratios, presented dwelling order subsidies, decreased house loan curiosity premiums and delivered money guidance to real estate providers. A tax on many attributes has also been delayed. In this situation, shares of quite a few true estate firms have rebounded by a lot more than 50%. Having said that, it should be mentioned that this modern rebound does not indicate a revival of toughness in the extensive-phrase fundamentals of the real estate sector. At the present, most of the real estates’ accommodative guidelines are carried out in China’s second and third-tier cities and there is no apparent change in guidelines that ruled the initially-tier cities’ authentic estate industry.

China’s main goal on the home sector is to realize a “gentle landing” and does not want a return to an unstable higher growth atmosphere pushed by abnormal leverage. On the other hand, as real estate contributes a incredibly massive proportion of China’s GDP, the realization of China’s 5.5% GDP goal for 2022 is dependent mainly on the actual estate sector, so it wants a loose monetary surroundings to assistance it. To sum it up, the present-day tempo of sharp rebound in the share costs of serious estate organizations is likely complicated to persist and some retracement on its share selling prices is anticipated in the brief expression. Nevertheless, in the context of monetary plan easing, the share costs will be secure total in the medium-expression.

How will China tech shares complete soon after oversold conditions?

Chinese tech companies these as Tencent, Alibaba and Meituan have continued to see major declines in their respective share selling prices this calendar year, generally due to the Russia-Ukraine war, international regulatory repression and the latest COVID-19 outbreak in China.

In the existing surroundings, the Chinese federal government has started to use guidelines to assistance these tech providers these types of as to allow them to record abroad. On 16 March, the Fiscal Commission of the Condition Council held a particular assembly that emphasised that it would actively introduce guidelines favourable to the industry and introduce contractionary insurance policies prudently which implied that the past a person-year of stringent regulatory clampdowns on the organization practices of know-how system organizations may perhaps stop before long.

In addition, many detailed firms have executed huge-scale share buyback programmes these types of as Alibaba.

China and US regulators have not long ago held numerous rounds of talks with the intention of resolving some lingering challenges in cross-border regulations that in turn minimizes the odds of China ADRs becoming delisted from US inventory exchanges. All in all, these hottest developments have managed to ease the damaging sentiment which will probably aid to gradual down the pace of the big downtrend of China tech shares.

Simply click in this article to examine Part 1 of Q2 2022 global markets rising themes

[ad_2]

Resource url

More Stories

Unlock Effortless Elegance Through the Modern Hairpiece

How a SaaS Marketing Agency Can Transform Your Software Business

Chain Link Fence Port St. Lucie: A Practical Blend of Strength and Simplicity