[ad_1]

A frequent element of most small-money nations is a govt that collects very little tax earnings and presents number of general public products. The literature on point out potential and improvement argues that the incapability to acquire taxes effectively is at the coronary heart of why lower-money nations around the world are as poor as they are (Besley and Persson 2009). This analysis suggests that the path to financial expansion for lower-cash flow nations may possibly begin with investing in the government’s potential to collect tax revenues (Albers et al. 2020), so as to deliver productivity-improving community merchandise. Several theories argue that know-how investments by tax administrations are central to growth in government dimension, which includes owing to effectiveness advancements in the selection approach (Brennan and Buchanan 1980, Becker and Mulligan 2003, Cowen 2021). Fan et al. (2018) give a recent examine in China on computerised VAT.

In this context, our new analysis (Dzansi et al. 2022) supplies descriptive and experimental evidence on the job of technology in bettering government tax capacity. The placing is regional governments in Ghana, which oversee selection of house taxes but accumulate pretty tiny in exercise (Governing administration of Ghana 2014). The engineering in query consists of a geospatial databases of houses embedded into an electronic tablet with GPS capabilities. Similar systems have seen a important enhance in adoption in establishing countries above the earlier 10 years (Fish and Prichard 2017).

To gauge the prospective for technological innovation to reduce capability constraints, we to start with executed a census of regional governments. We executed the census in the autumn of2017 in collaboration with many nationwide ministries and all 216 area governments in the place. The goal of the census was to gather details on just about every related dimension of the nearby tax selection method in just about every community federal government. 3 principal sets of respondents ended up interviewed: regional government officials, domestically elected assembly users, and citizens. In addition to the study information, we digitised and harmonised administrative documents to evaluate all resources of local tax collection and all sorts of community expenditure in just about every district.

The census facts highlighted how poor infrastructure for amassing taxes – with limited avenue naming and assets addressing – shapes collection methods in most locations. Just about all expenditures are hand-shipped by collectors to taxpayers, and collectors usually go to particular person taxpayers several occasions in advance of amassing (if they collect at all). The bulk of tax payments are created in cash and compensated right to profits collectors. Not astonishingly, government officials cite ‘leakages’ by tax collectors as a substantial constraint on their revenues. In this challenging context, 17% of regional governments have selected to undertake technological know-how to help with tax collection, in the sort of a profits administration program and digital databases of homes. We discover that this minority of community governments which chose to commit in technological innovation have considerably superior outcomes at each individual phase in the tax selection course of action. In specific, they deliver additional expenditures, acquire much more revenues, and have reduced non-payment costs than do governments without technological innovation.

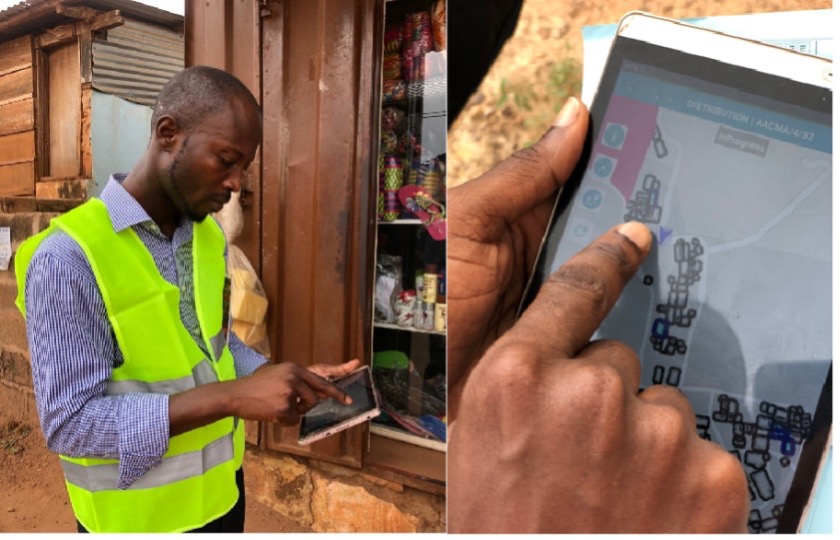

The limited empirical link amongst engineering use and tax assortment outcomes in the cross-segment of regional governments obviously invitations questions about the course of causality. To address this challenge, we partnered with a single massive municipal government in Ghana and a non-public technology company to randomise the use of its engineering in the government’s jurisdiction. In distinct, we randomised the use of a new income assortment program and geospatial databases of attributes at the level of a income collector. In the experiment, both equally remedy and handle collectors have been supplied a stack of close to 135 charges of identical benefit in a randomly assigned region and tasked with collecting as a great deal profits as attainable in six months. The treatment method group was offered an digital tablet that utilizes the geospatial facts to make locating homes simpler (see Determine 1). Or else, the two teams of collectors, and their assigned places, had been observationally very similar.

Determine 1

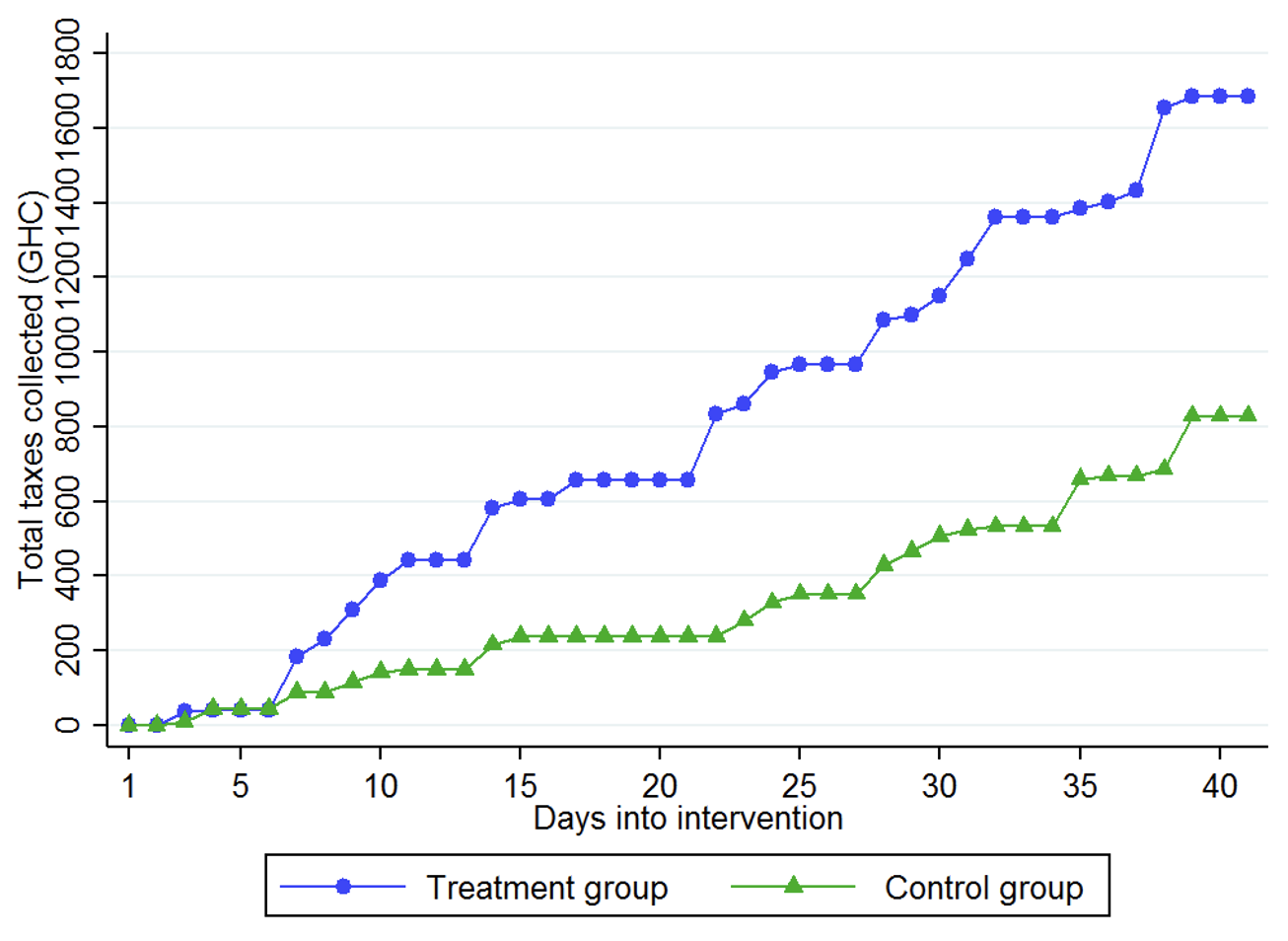

Notes: This graph reveals the ordinary amount of house taxes collected by profits collector, independently by day of the intervention and remedy assignment.

Income collectors that use the new know-how shipped 27% far more expenses than the regulate collectors by the stop of the analyze. We view this end result as reflecting the mechanical advantage that the engineering supplies in locating taxpayers far more efficiently in an setting with scant residence addressing. The time sequence of cumulative costs sent in the two teams exhibits a concave pattern, as collectors change emphasis above time from offering payments to adhering to up with the homes that were currently served a monthly bill in buy to gather payment from them. Earnings collections were 103% larger between the collectors assigned to the engineering team, on normal, implying a much much larger effect on revenue collections than on expenditures sent. In addition, we obtain that the therapy influence on collections grows in excess of time, top to a mounting typical result on the sum gathered per monthly bill sent via the training course of the experiment (Figure 2).

Determine 2

Notes: These illustrations or photos show the navigational aid delivered in the pill that is utilized by income collectors in the treatment team.

We examine various prospective hypotheses for why the treatment impact on collections is so substantially larger than the procedure impact on monthly bill deliveries. A single uncomplicated story is that homes have unique attitudes toward payment when visited by collectors who clearly show up with the engineering than by ‘status quo’ collectors with no the technology. Nevertheless homes in procedure and control parts surveyed ideal just after the experiment report statistically identical degrees of perceived integrity and potential to enforce tax payments between community government officers. A second hypothesis is that the technological innovation allows lessen leakages – for illustration, in the sort of payments designed by homes but diverted by earnings collectors ahead of achieving the nearby government’s coffers. Having said that, a number of forms of house study queries about the preponderance of bribe payments stage to modestly far more – somewhat than a lot less – bribe activity in treatment method locations than in command locations.

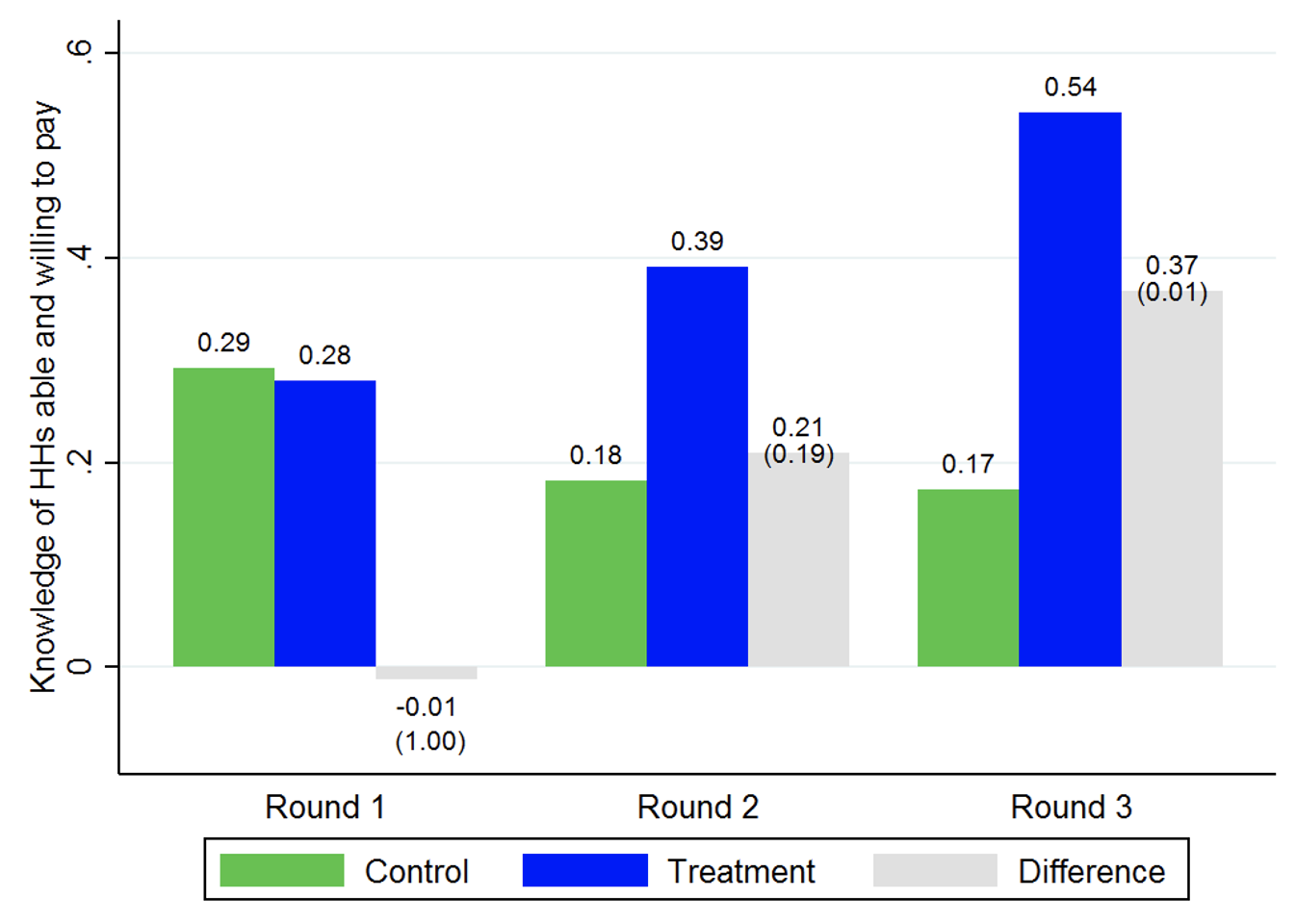

We argue that the most most likely mechanism is that the know-how lets collectors to find out about – and concentration their scarce time on – households that are most very likely to make tax payments. Employing surveys of collector conduct and strategies, we exhibit that procedure collectors about time report acquiring better expertise of personal households’ propensity to spend and target far more on amassing from households that are more capable to pay back, improved informed of taxpaying obligations, and a lot more pleased with regional general public goods (Determine 3). Importantly, none of these home attributes would have been known to the collectors at the start of the analyze interval. The implication is that technological innovation authorized collectors to learn, as a result of repeat visits (or extended visits), about domestic characteristics that are or else tricky to notice. Steady with this strategy, we document that homes with greater liquidity and bigger income – which are unobservable to the collectors ex ante – are extra likely to be specific by the treatment team than command team. We formalise this differential discovering mechanism in a very simple dynamic Beckerian time use design in which ahead-searching revenue collectors maximise cumulative earnings collections topic to a time constraint each individual time period.

Figure 3

Notes: This graph displays the extent to which collectors know where by the homes are found that are a lot more equipped to pay assets taxes, separately by study wave (baseline, midline, endline) and therapy assignment. The grey bar measures the variation in understanding involving the therapy and the management

Enhanced finding out through know-how has significant distributional impacts. The amplified information about home income gathered by the treatment collectors, and the subsequent concentrating on of higher-money homes, helps make the nearby tax program much more progressive. Precisely, technological innovation improves tax payments as a share of taxes because of in the best quartiles of the earnings-asset distribution, but leaves tax payments unchanged in the base quartile. Even so, improved information appears to be a double-edged sword, as know-how also boosts the incidence of bribes, with consequences concentrated in the base quartile. Further analyses suggest therapy collectors also understand about, and subsequently target, those households that are more inclined to interact in bribes. This is reliable with our most popular explanation about how technology facilitates discovering about which homes are extra probably to make tax payments.

Our experimental findings on technological innovation expenditure lose light on the promises and pitfalls of employing technological know-how to make tax ability, and the societal desirability have to stability the beneficial and progressive tax outcomes in opposition to the regressive bribe consequences. Our benefits recommend that the positive consequences of engineering on tax results are only partly thanks to the presence itself of digital gadgets embedded with geo-spatial information. Technological innovation permitted collectors to defeat finding out constraints in the discipline (in this scenario, stemming from navigational worries) which limited their potential to establish information about taxpayers’ propensity to shell out. Our conclusions for that reason relate to papers which demonstrate how pre-present data resources from 3rd get-togethers can be leveraged to improve assortment (Kleven et al. 2011, Pomeranz 2015, Naritomi 2019, Balan et al. 2022). Most prior reports location 3rd-party information at the heart of governments’ informational ability (Gordon and Li 2009, Kleven et al. 2016) our perform displays how, in options wherever these types of info sources are mainly non-existent, the condition can still strengthen its informational ability by directly creating information and facts about taxpayers’ propensity to spend.

References

Albers, T, M Jerven and M Suesse (2020), “On the enhancement of fiscal capability: New insights from African data”, Vox.EU.org, 22 November.

Balan, P, A Bergeron, G Tourek and J L Weigel (2022), “Local Elites as Condition Capacity: How City Chiefs Use Neighborhood Information and facts to Enhance Tax Compliance in the D.R. Congo”, American Financial Review 112(3): 762-97.

Becker, G and C Mulligan (2003), “Deadweight Fees and the Dimensions of Government”, The Journal of Regulation and Economics 46(2): 293-340.

Besley, T and T Persson (2009), “The Origins of Condition Capacity: Property Rights, Taxation, and Politics”, American Economic Evaluate 99(4): 1218-44.

Brennan, G and J Buchanan (1980), The Power to Tax, Cambridge College Push.

Cowen, T (2021), “Does Technologies Drive the Growth of Government?”, in Essays on Governing administration Growth, Springer.

Dzansi, J, A Jensen, D Lagakos and H Telli (2022), “Technology and Area Condition Ability: Proof from Ghana”, NBER Functioning Paper 29923.

Enthusiast, H, Y Liu, N Qian and J Wen (2018), “The dynamic consequences of computerized VAT invoices on Chinese manufacturing firms”, VoxEU.org, 29 July.

Gordon, R and W Li (2009), “Tax Structures in Acquiring Nations around the world: Numerous Puzzles and a Probable Explanation”, Journal of General public Economics 93(7-8): 855-866.

Govt of Ghana (2014), “Internally Generated Profits Strategy and Pointers: Maximizing Internally Created Income Potentials for Enhanced Nearby Amount Provider Delivery”, Ghana, Ministry of Finance.

Fish, P and W Prichard (2017), “Strengthening IT Systems for Residence Tax Reform”, African Home Tax Initiative Transient.

Kleven, H J, M B Knudsen, C T Kreiner, S Pedersen and E Saez (2011), “Unwilling or Not able to Cheat? Evidence from a Tax Audit Experiment in Denmark”, Econometrica 79(3): 651-692.

Naritomi, J (2019), “Consumers as Tax Auditors,” American Economic Evaluate 109(9): 3031-72.

Pomeranz, D (2015), “No Taxation with out Facts: Deterrence and Self-enforcement in the Price Added Tax”, American Economic Overview 105(8): 2539-69.

[ad_2]

Resource connection

More Stories

Top 5 Innovative IT Insurance Services

First Steps in Designing a Pantry

Fun Facts About Radio