[ad_1]

If you want to know who definitely controls International Technological innovation Acquisition Corp. I (NASDAQ:GTAC), then you are going to have to appear at the makeup of its share registry. Substantial companies usually have institutions as shareholders, and we typically see insiders possessing shares in lesser organizations. We also are likely to see decreased insider ownership in organizations that had been earlier publicly owned.

Worldwide Technological innovation Acquisition I is not a massive enterprise by world requirements. It has a industry capitalization of US$251m, which means it would not have the attention of lots of institutional traders. In the chart underneath, we can see that establishments are visible on the share registry. Let us delve further into each and every form of owner, to learn a lot more about World-wide Technologies Acquisition I.

Look at our newest analysis for World wide Technologies Acquisition I

What Does The Institutional Ownership Convey to Us About Worldwide Technologies Acquisition I?

Establishments normally evaluate on their own from a benchmark when reporting to their own buyers, so they usually develop into much more enthusiastic about a stock as soon as it is bundled in a major index. We would assume most companies to have some institutions on the register, primarily if they are increasing.

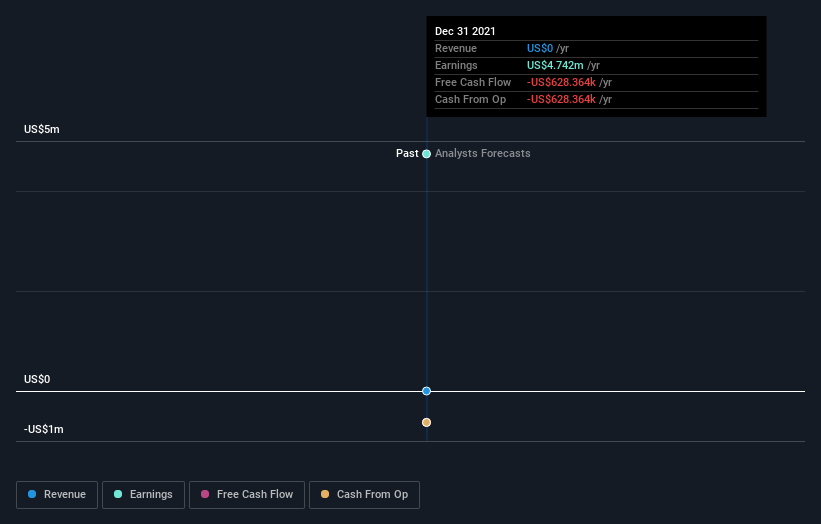

World wide Technologies Acquisition I now has institutions on the share registry. Certainly, they own a respectable stake in the enterprise. This indicates some credibility amongst expert investors. But we can not depend on that simple fact by yourself because institutions make negative investments occasionally, just like all people does. If many institutions improve their view on a inventory at the identical time, you could see the share rate fall speedy. It really is consequently worthy of wanting at World-wide Know-how Acquisition I’s earnings background under. Of course, the foreseeable future is what genuinely issues.

Our information suggests that hedge resources very own 5.5% of Worldwide Technology Acquisition I. That is exciting, simply because hedge resources can be rather lively and activist. A lot of glimpse for medium phrase catalysts that will push the share selling price better. International Know-how Acquisition I Sponsor Lp is at present the company’s biggest shareholder with 20% of shares excellent. For context, the next most significant shareholder retains about 5.5% of the shares superb, followed by an possession of 3.6% by the third-largest shareholder.

A nearer search at our possession figures implies that the leading 16 shareholders have a put together ownership of 50% implying that no one shareholder has a majority.

Whilst it tends to make perception to study institutional ownership knowledge for a organization, it also can make sense to analyze analyst sentiments to know which way the wind is blowing. We’re not picking up on any analyst coverage of the inventory at the minute, so the firm is not likely to be broadly held.

Insider Possession Of Global Technologies Acquisition I

The definition of an insider can differ a bit amongst various countries, but customers of the board of directors generally depend. Management in the end solutions to the board. However, it is not uncommon for administrators to be executive board associates, specially if they are a founder or the CEO.

Insider ownership is beneficial when it signals management are pondering like the real owners of the company. On the other hand, higher insider ownership can also give huge electric power to a tiny group inside the firm. This can be destructive in some conditions.

Our facts implies that Worldwide Technological innovation Acquisition Corp. I insiders have under 1% of the enterprise. But they may well have an indirect desire as a result of a corporate composition that we have not picked up on. It seems that the board retains about US$1.2m worthy of of stock. This compares to a current market capitalization of US$251m. We normally like to see a board much more invested. Nevertheless it may well be value checking if those people insiders have been acquiring.

General General public Ownership

With a 47% possession, the basic general public, mostly comprising of personal traders, have some diploma of sway about Worldwide Know-how Acquisition I. While this group can’t automatically connect with the photographs, it can unquestionably have a real affect on how the organization is run.

Personal Company Ownership

Our information indicates that Non-public Corporations maintain 20%, of the company’s shares. It could possibly be value hunting further into this. If associated get-togethers, this sort of as insiders, have an curiosity in one of these private corporations, that should really be disclosed in the annual report. Private corporations may perhaps also have a strategic curiosity in the company.

Upcoming Methods:

Though it is well truly worth taking into consideration the various groups that possess a company, there are other factors that are even much more important. Think about for occasion, the ever-present spectre of investment decision risk. We’ve determined 3 warning indicators with International Technologies Acquisition I (at the very least 2 which you should not sit too properly with us) , and knowledge them should be part of your investment procedure.

Of training course this may well not be the very best inventory to purchase. So take a peek at this cost-free free record of interesting companies.

NB: Figures in this short article are calculated utilizing info from the previous twelve months, which refer to the 12-month period ending on the previous date of the thirty day period the economical assertion is dated. This may perhaps not be reliable with complete calendar year yearly report figures.

Have feedback on this write-up? Involved about the content? Get in touch with us instantly. Alternatively, e mail editorial-group (at) simplywallst.com.

This posting by Just Wall St is normal in character. We offer commentary primarily based on historic knowledge and analyst forecasts only utilizing an impartial methodology and our articles or blog posts are not meant to be fiscal information. It does not constitute a suggestion to obtain or provide any stock, and does not take account of your goals, or your money predicament. We aim to provide you prolonged-time period focused investigation pushed by fundamental data. Notice that our analysis could not element in the most recent rate-sensitive corporation bulletins or qualitative substance. Basically Wall St has no place in any shares talked about.

[ad_2]

Supply url

More Stories

Unlock Effortless Elegance Through the Modern Hairpiece

How a SaaS Marketing Agency Can Transform Your Software Business

Chain Link Fence Port St. Lucie: A Practical Blend of Strength and Simplicity